Italian Prime Minister Giorgia Meloni recently confirmed that the government is ready for the privatisation of the national railway holding Ferrovie dello Stato (FS Group). RailFreight.com had a chat with Dr. Andrea Giuricin, transport economist at the Milan-Bicocca Univesity, who pointed out that the most desirable asset of the group is infrastructure manager Rete Ferroviaria Italiana (RFI).

The idea of selling a minority stake in the FS Group was brought up because Italy needs to find resources to fund its 2024 budget law. The two main assets of the FS Group are RFI and passenger service operator Trenitalia, as Giuricin stated. “Both these companies are doing quite well, but it will be difficult to set the value of the whole cluster given the many companies forming it”, he pointed out.

When it comes to similar initiatives, investment groups or big banks are usually tasked with estimating the value of an entity. “However, this is a relatively new segment when it comes to privatisation of this size. It will be interesting to see how the evaluation process pans out, especially considering the presence of RFI”, he said.

The State would remain in charge

An attempt to privatise FS Group already took place in 2015, under the government led by Matteo Renzi. “Back then the group was valued at about 10 billion euros”, Giuricin explained. Nine years ago, the process started but was not completed. This time, however, might be the one since the current Meloni-led government seems more stable and more keen to carry out the initiative.

The privatisation of the FS Group was brought up during the Prime Minister’s end-of-year press conference, making the government’s intentions quite clear. The State would remain the entity making the decisions, as the plan seems to entail the sale of a minority stake in FS, probably around 40 per cent. However, Giuricin highlighted that an effective privatisation process should boost efficiency. “Private investors might put some pressures on the public entity”, he underlined.

It needs to be mentioned that the process could be halted if the current government falls and is replaced by a coalition with different views, which is what happened in 2015. “It is an extremely complex operation, especially considering the involvement of RFI. However, it still is quite feasible”, Giuricin pointed out, saying it will probably take at least two years. He also added that this process shows how Italy, at least in this regard, is somewhat of a forerunner. No other countries in the EU have been seriously considering such an option.

An interesting deal for institutional funds

Giuricin thinks that this initiative might arouse the interest of various institutional funds. This is especially true when considering the inclusion of RFI, as infrastructure management brings in stable flows, and investments often have a long-term scope. Something similar happened in the rail passenger sector, with infrastructure fund manager Global Infrastructure Partners buying shares of Italo. However, there is also the possibility of attracting smaller Italian investors.

The FS Group

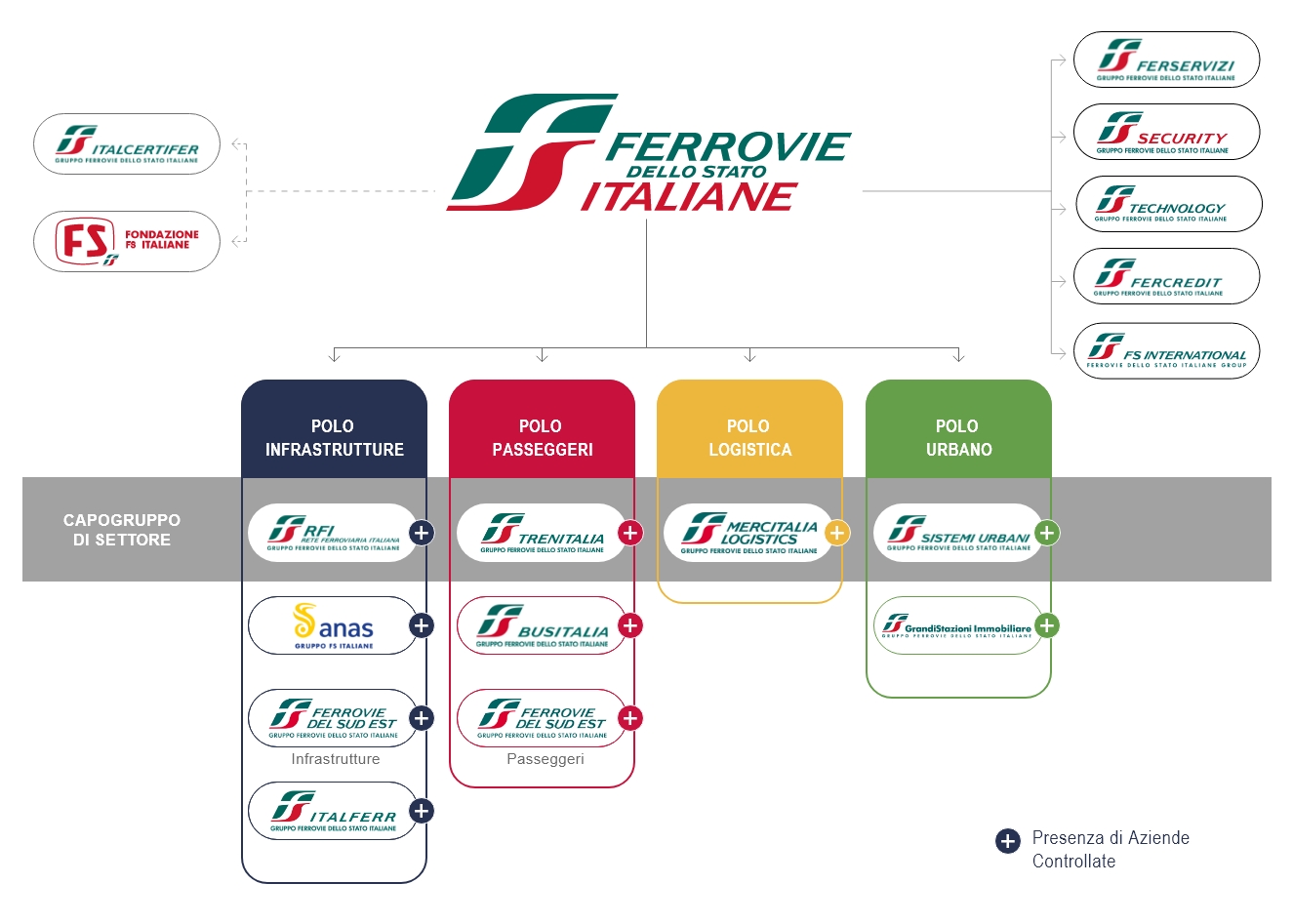

As stated by Giuricin, the size of the FS Group makes it difficult to estimate its value. The holding controls 17 groups, which comprise 32 companies including road and rail infrastructure management, passenger and freight operators and consulting firms.

Also read: