Victorian Premier Jacinta Allan is counting on a growing economy and an interest rate cut later this year to curb the state’s $26 million a day debt interest bill as she hands down a budget sweetened by $400 handouts for families but with few tough cuts.

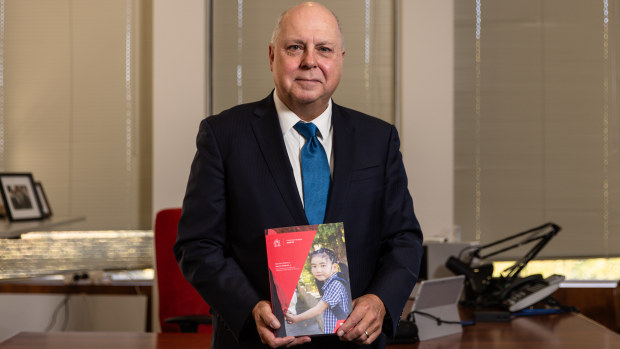

Treasurer Tim Pallas delivered a $15.2 billion deficit on Tuesday with net debt growing from $156 billion next year to $188 billion by 2028 but forecast an operating surplus of $1.5 billion by 2025-26.

There are no new taxes or levies for the first time in several years, but the deficits are forecast to turn around through a combination of a growing economy – which is expected to expand from $609 billion to $748 billion by 2028 – and a slowdown in the major project pipeline, including no new money for the $10 billion Melbourne Airport Rail.

There is also a slowdown in the rollout of 30 government-owned and operated early childcare centres, a delay to 29 school upgrades across the state, a delay in the rollout of 60 mental health centres and also no money for five new community hospitals previously promised.

The government announced a 10 per cent cut to the public service last year, equal to around 3000 job losses with 1400 roles so far cut, the government said on Tuesday.

New spending

But the budget still introduces $3.4 billion in new spending initiatives this year, the public sector wages bill grows from $38 billion to $42 billion and the interest on the growing debt will climb from $6.5 billion in 2024-25 to $9.37 billion by 2028. Interest as a share of revenue will rise from 6.3 per cent to 8.8 per cent over that time.

“What I’m not going to do is oversight a budget that takes the economic momentum out of the economy. The important thing is to get that right in terms of the choices the government makes,” Mr Pallas said.

Net debt is expected to reach $156.2 billion in June 2025 and $187.8 billion by 2028. Net debt as a share of gross state product is projected to hit 24.4 per cent in June 2025, 25.1 per cent in 2026, and remain at 25.1 per cent by 2027-28. That is far higher than the peak of 16 per cent reached in the post-Cain-Kirner recession in 1993.

“Times are tough for many Australians. Inflation is hurting. Interest rates are higher, and the cost of groceries, petrol and bills continues to rise. That’s why this budget is focused, firstly, on helping families,” Mr Pallas said.

“From help with the cost of living, to investment in education, healthcare, road and rail, we want to make life easier.

“Secondly, this is a budget focused on fiscal discipline, making sensible decisions that respond to the challenges ahead. It considers our two big problems – high inflation and workforce shortages – and how we best manage them.

“And thirdly, this is a budget for the future. We want our prosperous economy to stay strong. In this budget, we’re making sensible choices. We’re helping families. And we’re building a strong future for Victoria.”

‘Car park operator’: airport project slight

Mr Pallas said infrastructure investment would moderate to $15.6 billion by 2027-28, after reaching almost $25 billion this year.

The slowdown includes no money for the $10 billion Airport Rail Link for at least four years, despite the federal government committing $5 billion to the project. Labor has blamed the delay on Melbourne Airport “continuing to demand compensation and an underground station”.

“We’re basically not in a position to have any certainty of what stage this project proceeds, largely because we’ve got an airport concessionaire who chooses not to facilitate the building of the project,” Mr Pallas said.

“Quite frankly, we’re not paying for undergrounding to effectively line the asset base of the concessionaire. We’ve had to take an assessment of how long that delays the project – nobody knows for certain, but given we can’t control it, we’ve taken the not unreasonable expectation it could take four years.

“Of course, were the airport concessionaire to see reason and maybe become a good corporate citizen at some point, instead of a really good car park operator, then perhaps we might be able to move those things forward.”

Banking on a rate cut

The government says it is counting on a rate cut this year.

“We’re hearing from economic prognosticators that we’re starting to see factoring in of those lower interest rates going forward. (But) we’re not sitting back praying for rain, we’re recognising that we’re in an event at the moment and that we have to factor in those interest rates and deal with them,” Mr Pallas said.

While the government claims fiscal responsibility, the budget includes a $400 bonus for around 700,000 students. The $287 million cash-for-kids scheme will provide one-off payments for every child at a government school and eligible concession cardholders at other schools. There is another $200 for eligible families for sporting memberships, uniforms and equipment.

The government has also promised an extra $700 million for the state’s $2.1 billion Homebuyer Fund shared equity scheme.

AFR