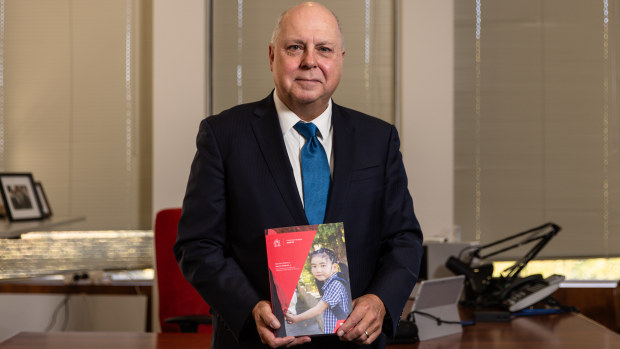

Popular major state projects – including the Airport Rail Link — have been put on the backburner as part of the Victorian government’s pitch to be more fiscally responsible, in Treasurer Tim Pallas’s 10th budget.

Parents will get the biggest budget sweetener, with $400 to help with education expenses for children at government schools, as Premier Jacinta Allan tries to focus on families in her first budget in the top job.

Despite the rhetoric of better economic management, Victoria’s net debt continues to climb.

Net debt is now forecast to hit $187.8 billion by 2027-28, when Victorians will be paying roughly $25 million each day on interest payments.

The budget faces a $2.2 billion deficit this financial year but is projected to return to a surplus of $1.5 billion by 2025-26.

Treasurer Pallas has defended the budget as one that strikes a responsible balance without taking “the economic momentum out of the economy”.

Mr Pallas said his government was focused on moving past COVID debt by reducing net debt as a proportion of the state’s economy.

Budget figures show debt debt represented roughly 20 per cent of gross state product (GSP) in 2022-23, and is set to climb to 25.2 per cent in 2026-27, before dropping slightly to 25.1 per cent the following year.

When pressed on the impact of that debt on future generations, the treasurer said it was important the figures were viewed in context.

“I can assure Victorians that our priorities are on the commitments we gave them and recognise the material circumstances of the time and do no harm to the continuing growth and resurgence of the Victorian economy,” he said.

Mr Pallas said a reduction in government advertising and selling government office spaces were among the measures that would keep government expenditure at an average growth rate of 2.2 per cent per year.

“Pretty profound in anyone’s language,” he said.

“You haven’t seen that in this state for 15 years.”

Credit ratings agency says ‘thin’ forecast surplus key to maintaining AA rating

Credit rating agency S&P Global Ratings downgraded Victoria’s credit rating from AAA to AA in 2020 — the lowest of any state or territory in Australia.

The agency said this year’s budget confirmed the government’s accounts were in “large structural fiscal cash deficit”.

“This is the highest among the Australian states and stems from successive operating deficits and its large capex [capital expenditures] since the pandemic hit in late fiscal 2020,” the agency said in a statement after the budget was released.

“Debt to operating revenues has almost tripled since this time. Victoria’s serviceability costs are also rising.

“On the flipside, we believe Victoria maintains strong access to global capital markets.

“This will allow the government to fund its budget and avoid any acute stress scenario, despite rising interest expenses and market volatility.”

The agency said it expected Victoria’s AA credit rating would be supported by the state’s wealthy and diverse economy, but pressure on the rating could build if the “thin” operating surplus forecast in the budget was not achieved.

State Opposition Leader John Pesutto said the budget was a missed opportunity to make life easier for Victorians and change the direction of the state.

“With record debt, record interest, record taxes, service cuts and poorer outcomes, it’s clear Labor cannot manage money and Victorians are paying the price,” he said.

Worker shortages drive delays across mental health, pre-prep programs

The government will also scrap the COVID-era sick pay guarantee, which was introduced to assist casual workers who needed to isolate while unwell.

As recently as last year, the government had considered extending the scheme permanently through an industry levy, but the budget papers confirmed it would be discontinued.

The government said difficulty in finding workers had also forced it to push back delivery timelines for its pre-prep programs in some areas.

Workforce shortages were also cited as the main reason for the government delaying the rollout of 35 planned walk-in mental health clinics.

Budget papers stated Victoria could not find the additional 2,500 psychologists, psychiatrists and mental health nurses needed to support the services.

But the government is still injecting $10 billion into the healthcare system, including $1.4 billion to progress the delivery of upgrades at the Austin Hospital, Monash Medical Centre and Northern Hospital in Melbourne.

The government has also moved the proposed expansion of the Royal Melbourne and Royal Women’s hospital site from Arden to the existing location in Parkville.

The plan to build a new hospital campus near the soon-to-open Arden station was announced in 2022, but according to budget papers, has been deemed “unviable” due to “electromagnetic interference” from trains.

In regional Victoria, $5.4 million has been set aside to build a mental health, alcohol and drugs hub at the Ballarat Base Hospital’s emergency department.

Airport ‘stand-off’ sees delay of at least four years

Several big-ticket infrastructure items have also had their timelines pushed back, including the Airport Rail Link, which the government has indicated will be delayed by at least four years.

Mr Pallas said that was due to the “stand-off” with the airport over the station’s design that was unlikely to be resolved soon.

Melbourne Airport, which has long advocated for an underground station rather than one above ground, responded to Mr Pallas’s comments shortly after the budget was handed down.

“Melbourne Airport was part of a consortium that offered up to $7 billion towards an underground airport station and express tracks from Sunshine,” a spokesperson for the airport said.

“The state government rejected this. The timing of the project has always been a matter for government.”

A level crossing removal project for the busy Upfield train line, which runs through Brunswick in Melbourne’s inner-north, has also been delayed until at least 2030.

But $996 million has been set aside to get ready to open the Metro Tunnel rail project and the West Gate Tunnel next year.

The budget also set aside $139 million in a bid to attract and retain more teachers in Victorians schools.

The measure includes $63 million to go towards the mental health and wellbeing of school staff.

Increase in fire services levy and tip fees

While there were no major tax hikes, the government is asking ratepayers to contribute more to fund the state’s firefighting services, through an increase to the fire services property levy.

From July, the median residential property owner will pay an additional $35, while primary production properties will face a $150 rise.

It’s also increased the state’s waste levy, which is paid by people dumping rubbish at their local tip.

It currently sits at $129.27 per tonne for metropolitan industrial and municipal waste left at the tip. But from July next year, it will increase to $169.79 per tonne.

The government says a “proportional” increase will also be applied at rural landfills, which attract lower levies than those in the city.

The budget figures also highlighted the extreme difficulty faced by young Victorians seeking to own a home in the state.

Budget analysis highlighted that in the mid-1990s, the average Victorian house price was roughly 3.5 times average household incomes.

But in the last few years, that ratio has doubled, recently peaking at seven times average incomes.

It means the average time taken for 25 to 34-year-olds to save for a deposit has risen from five years in the mid-90s to seven or eight years more recently.

In recognition of this, the budget has allocated $700 million to extend the government’s Victorian Homebuyer Fund, where the government assists homebuyers by taking a stake in the purchase.

How Victoria’s budget has been received

Victorian opposition:

- Accused the government of a decade of financial mismanagement

- Criticised the government for cutting important services while still spending big on infrastructure projects

- Found regional households will be hit by increases to fire services and waste levies

Victorian Greens:

- Labelled it a “do-nothing” budget that will make the housing crisis worse, arguing there is nothing for renters and no investment for new housing

- Suggested the government should have imposed more taxes on banks and corporations to fund housing and cost-of-living relief

ABC