Consumers are set to pay more for imported goods and farmers more to export food and fibre, under an Allan government carbon tax on trucks moving through the Port of Melbourne.

Trucks will be slugged with a tiered tax of $150 to $250 per container, based on each vehicle’s age and carbon emissions, which will be used to subsidise rail freight.

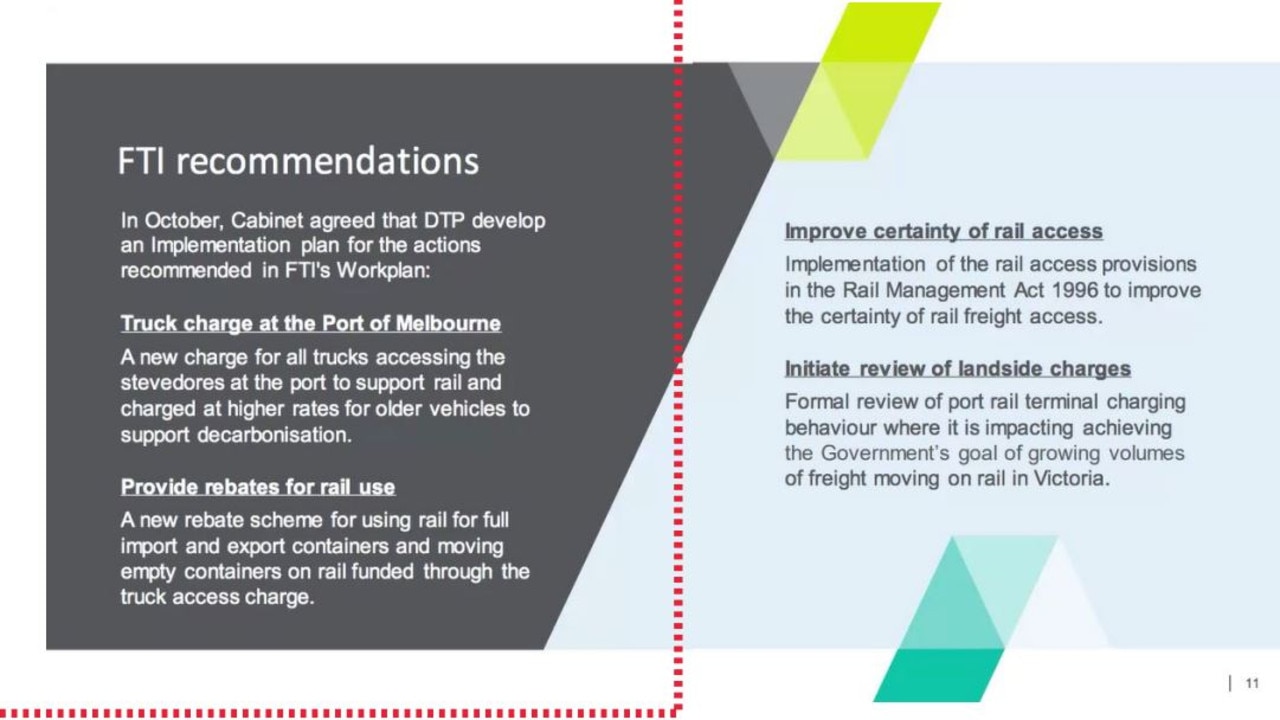

Department of Transport and Planning briefing documents state Cabinet agreed in October to develop “a new charge for all trucks accessing the stevedores at the port to support rail and charged at higher rates for older vehicles to support decarbonisation”.

The documents show the cash-strapped Allan government wants to use the truck tax to fund “a new rebate scheme for full import and export containers, and moving empty containers, on rail”.

The tax, which is expected to raise more than $300m a year, will initially be used to fund the Port Rail Shuttle (PRS) Network project, which the DTP briefing states the government and industry have struggled to fund.

Department of Transport and Planing briefing document – extract

The DTP is set to deliver its implementation plan to the government on introducing the truck charge by next month.

Opposition ports and freight spokeswoman Roma Britnell called on the Labor government to “immediately rule out imposing a truck tax on the Port of Melbourne”.

“This ludicrous approach by Labor will raise the cost of freight on roads, costing Victorians more for goods.

“Instead of making rail more competitive by investing in it, this will simply make road freight more expensive and is no solution to Labor’s long neglect of Victoria’s rail freight network.”

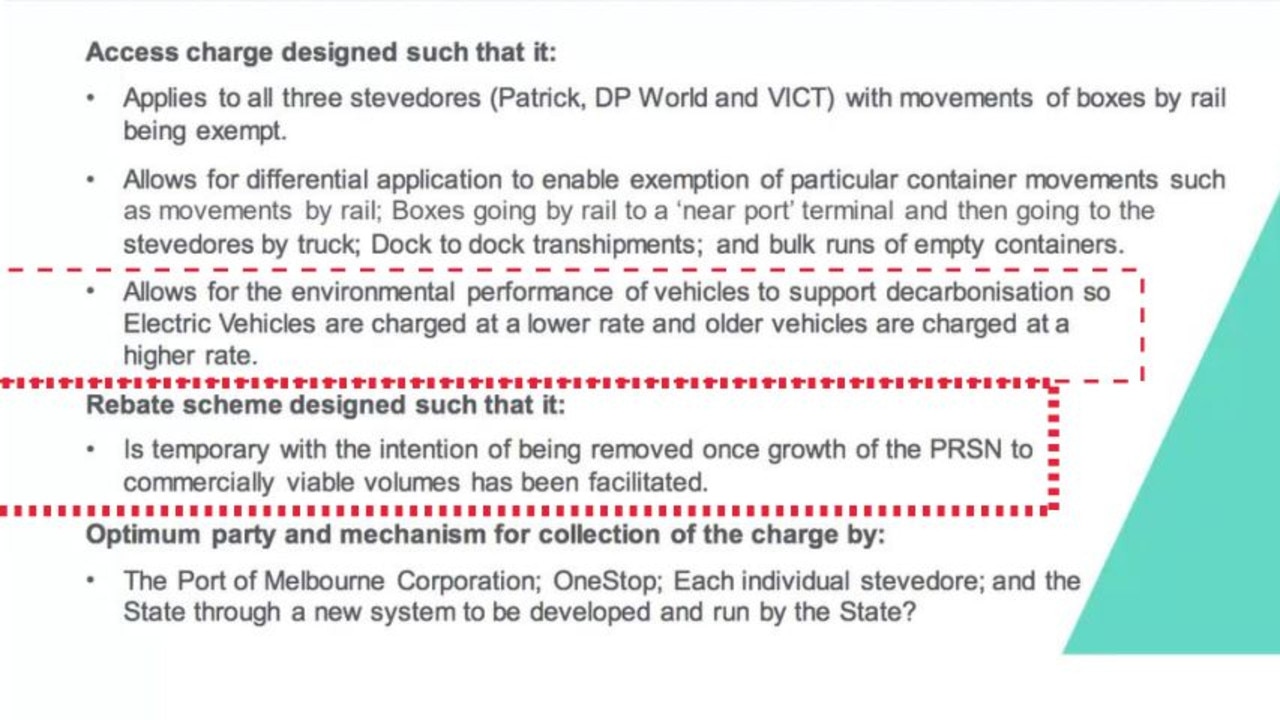

The DTP brief states the rail rebate “is temporary, with the intention of it being removed once growth of the PRS Network to commercially viable volumes has been facilitated”.

Department of Transport and Planing briefing document – extract

What happens to the tax take beyond that point remains a mystery, although Ms Britnell said “one of the obvious concerns is that the money will be sunk into the Suburban Rail Loop, rather than infrastructure to get freight on to rail”.

Farmers and agribusiness groups in northwest Victoria have called on the government to stop the truck tax and improve rail efficiency on the Murray Basin Freight Rail Network.

In letters to the Victorian and National Farmers’ Federation, the Ouyen Inc group says “the proposed tax will ultimately hit farmers, exporters, freight accumulators and the communities of the Murray Basin region, an estimated $147 million to $247 million over a 10-year period to 2035 alone”.

Source: HeraldSun