Australia is set to host the largest data centre capacity in the Asia Pacific region outside the population outliers of China and India, according to new research from ratings agency Moody’s.

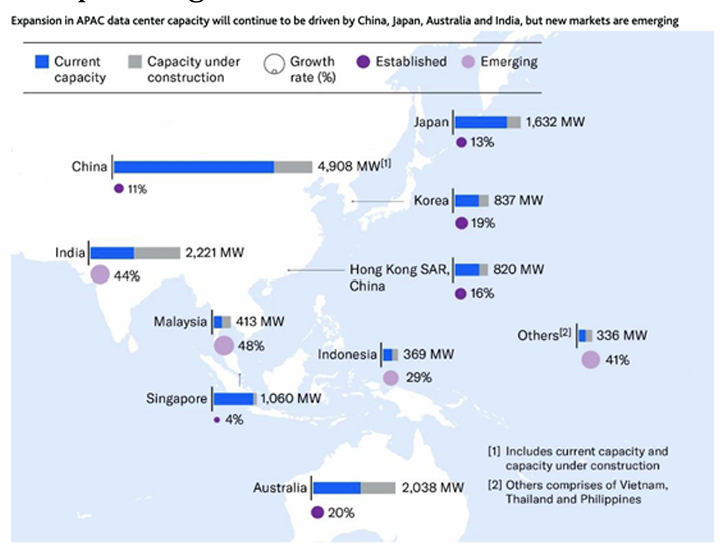

According to the report, Australia’s data centre capacity, both current and under construction, stands at 2,038 megawatts, representing a 20% compounded annual growth rate between 2023 and 2026. The total capacity puts Australia as the third largest data centre market at the end of the forecast period, behind only China (4,908MW) and India (2,221MW), but highest among all other Asian countries, including established markets like Japan (1,632MW) and Singapore (1,060MW). Further, Australia’s 20% CAGR ranks top among established markets — Korea (19%), Hong Kong (16%), Japan (13%), China (11%) and Singapore (4%).

For the region overall, Moody’s forecasts continue data centre growth fuelled by increased cloud, artificial intelligence and cryptocurrency adoption, while other factors such as regulation, power and water availability and geopolitics will also impact investment decisions.

“We forecast APAC data centre capacity to grow at a CAGR of almost 20% through 2028, to about 24,800MW – more than double the current capacity of over 10,500MW,” Moody’s said. “APAC constitutes about 30% of global capacity expansion over the next five years.

This expansion will involve investment of over US$564 billion through 2028. “Capacity in emerging data centre markets, including India, Indonesia, Malaysia, Thailand and Philippines, will record growth rates of 29%-48% through 2025 given the smaller amount of existing capacity today, coupled with governments’ digital agendas and investor support. In more established markets such as mainland China, Japan, Australia, Singapore, Hong Kong SAR, China and Korea, data centre capacity will also continue to grow, but at a slower pace of 4%-20% given the larger base of existing capacity, geopolitical and data sovereignty concerns, and land availability.”

In its analysis, Moody’s sees growing investment in emerging markets as data centre developers diversify their locations as a result of the geopolitical tension between the US and China. At the same time, a combination of regulation, such as tighter data sovereignty laws, and incentives that include tax relief, subsidies and preferential electricity rates will amplify growth in emerging data centre markets, the rating agency added.

TELCO BENEFITS: In light of the data centre market development trend in APAC, Moody’s said telcos now have an opportunity to “diversify and adapt their revenue streams” to offset income declines in legacy businesses.

“More available capacity for data processing and storage bene its telcos by improving network reliability and reducing latency as data consumption grows,” Moody’s said. “It also complements other offerings such as cloud, and information and communication technology services. Telcos can further bene it by cross-selling data centre services to their enterprise customers.” Moody’s points to Singtel, NTT, Telekom Malaysia, PLDT and Telkom Indonesia among others as telcos that have formulated data centre strategies.

“Telcos have varying exposure to the data centre industry, with most owning and operating multiple data centres for their own operations and to lease out space on a retail or wholesale co-location basis to various enterprise, including hyperscale tenants,” Moody’s said.

“Telcos are also using joint venture structures to partner with domestic companies or even energy companies to establish greener data centre pro jects.” As examples, Moody’s pointed to Singtel’s series of JVs for data centre expansion in Indonesia (with Telkom and Medco Power) and Thailand (with Gulf’s Energy Development PLC and AIS) in 2022 and 2023 respectively.

“The structure has allowed Singtel to tap into the technical know-how of power generation companies and local expertise of domestic telcos, reducing execution risk,” the firm added.

Tony Chan (Commsday)